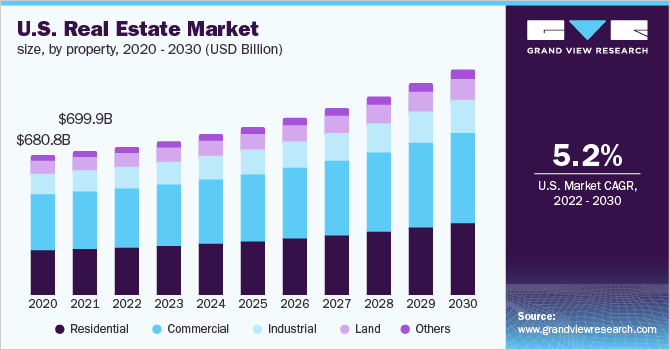

The real estate market is a dynamic sector influenced by numerous factors including economic conditions, demographic shifts, technological advancements, and global events. In 2024, several trends and patterns are emerging that are shaping the market and impacting buyers, sellers, investors, and policymakers. This article delves into the current market trends and provides an in-depth analysis of the factors driving these changes.

1. Current Market Trends

a. Urbanization and Suburbanization: The dichotomy between urban and suburban living continues to evolve. While urban areas were historically the epicenter of economic and social activities, the COVID-19 pandemic accelerated a shift towards suburbanization as people sought more space and affordable living conditions. In 2024, this trend persists with a balanced resurgence in urban living driven by young professionals and a sustained interest in suburban areas by families seeking larger homes and better quality of life.

b. Housing Supply and Demand: The real estate market in 2024 is characterized by a significant demand-supply imbalance. Housing supply remains constrained due to factors such as labor shortages in the construction industry, rising material costs, and regulatory hurdles. On the demand side, low-interest rates and demographic factors, particularly the homebuying interest from millennials, are fueling a high demand for housing. This imbalance is leading to increased home prices and a competitive market environment.

c. Technological Integration: Technology continues to revolutionize the real estate industry. The adoption of digital tools such as virtual reality (VR) for property tours, blockchain for secure and transparent transactions, and artificial intelligence (AI) for market analysis and property management is becoming mainstream. These technologies are enhancing the efficiency, transparency, and accessibility of real estate transactions.

d. Sustainability and Green Building: Environmental sustainability is becoming a priority in real estate development. In 2024, there is a notable increase in the demand for green buildings that incorporate energy-efficient designs, renewable energy sources, and sustainable materials. This trend is driven by both regulatory requirements and consumer preferences for eco-friendly living environments.

2. Regional Market Insights

a. Major Urban Centers: Cities like New York, San Francisco, and Los Angeles are witnessing a revival in demand for urban living. Despite the high cost of living, these cities offer unparalleled amenities, job opportunities, and lifestyle benefits that attract young professionals and high-net-worth individuals. The luxury real estate segment in these areas is particularly strong, with high demand for upscale apartments and condos.

b. Sunbelt States: States such as Texas, Florida, and Arizona are experiencing significant population growth and real estate development. The Sunbelt region offers a favorable climate, lower cost of living, and business-friendly environments, making it attractive for both individuals and businesses. Cities like Austin, Miami, and Phoenix are hotspots for real estate investment, with robust demand for residential and commercial properties.

c. Rural and Exurban Areas: The trend towards remote work has opened up new opportunities for rural and exurban areas. These regions, which offer affordable housing and a peaceful lifestyle, are becoming increasingly popular among remote workers and retirees. Real estate markets in these areas are benefiting from the influx of buyers seeking alternatives to urban and suburban living.

3. Economic Factors Affecting Real Estate

a. Interest Rates: Interest rates play a crucial role in the real estate market by influencing borrowing costs for homebuyers and investors. In 2024, interest rates remain relatively low, continuing to support strong demand for mortgages. However, any signs of rate hikes by central banks to curb inflation could impact market dynamics by making borrowing more expensive and potentially cooling down the overheated housing market.

b. Inflation: Inflationary pressures are a significant concern in 2024. Rising prices for goods and services, including construction materials, are impacting housing affordability and development costs. Real estate investors are closely monitoring inflation trends and their potential impact on property values and rental yields.

c. Employment and Income Trends: Employment levels and income growth are critical drivers of real estate demand. The labor market recovery post-pandemic has been uneven, with certain sectors thriving while others struggle. Strong job growth in technology, healthcare, and finance is supporting demand in specific real estate markets, while income disparities are influencing housing affordability and rental market dynamics.

4. Demographic Shifts and Their Impact

a. Millennial Homebuyers: Millennials, now in their prime homebuying years, are a significant force in the real estate market. This generation values homeownership and is actively seeking properties that offer modern amenities, energy efficiency, and proximity to work and social activities. Their preferences are shaping market trends and driving demand in both urban and suburban areas.

b. Aging Population: The aging population is another key demographic factor influencing real estate trends. Baby boomers, many of whom are downsizing or seeking retirement-friendly communities, are impacting demand for smaller homes, condominiums, and senior living facilities. This trend is leading to growth in the development of age-restricted communities and accessible housing options.

c. Remote Work and Mobility: The rise of remote work is reshaping residential preferences and mobility patterns. People now have greater flexibility to choose their living locations based on lifestyle preferences rather than proximity to their workplace. This shift is contributing to the popularity of suburban, exurban, and rural areas, as well as secondary cities that offer a high quality of life at a lower cost.

5. Technological Advancements and Their Influence

a. PropTech Innovations: Property technology (PropTech) innovations are transforming how real estate transactions are conducted and properties are managed. Technologies such as AI-driven analytics, IoT-enabled smart homes, and blockchain for secure transactions are enhancing the efficiency and transparency of the real estate market. PropTech solutions are also enabling better decision-making for investors and improving tenant experiences.

b. Virtual and Augmented Reality: Virtual reality (VR) and augmented reality (AR) are becoming integral tools in real estate marketing and sales. These technologies allow potential buyers to take immersive virtual tours of properties, enabling them to make informed decisions without physical visits. AR is also being used to visualize property renovations and interior designs, enhancing buyer engagement and satisfaction.

c. Big Data and Analytics: The use of big data and analytics is providing valuable insights into market trends, property values, and consumer preferences. Real estate professionals are leveraging data analytics to identify investment opportunities, optimize property management, and enhance marketing strategies. The ability to analyze vast amounts of data in real-time is giving stakeholders a competitive edge in the market.

6. Sustainability and Green Building Practices

a. Energy Efficiency: Energy-efficient homes are in high demand as consumers become more environmentally conscious and seek to reduce their utility costs. Green building certifications such as LEED (Leadership in Energy and Environmental Design) are becoming important differentiators in the market. Developers are incorporating energy-efficient designs, insulation, and renewable energy sources to attract eco-conscious buyers.

b. Sustainable Materials: The use of sustainable and eco-friendly materials in construction is gaining traction. Builders are opting for materials with lower environmental impact, such as recycled steel, reclaimed wood, and low-VOC (volatile organic compound) paints. These practices are not only environmentally friendly but also appeal to buyers who prioritize sustainability in their purchasing decisions.

c. Government Regulations: Government policies and regulations are increasingly promoting sustainable building practices. Incentives such as tax credits for energy-efficient upgrades and stricter building codes are encouraging developers to adopt green building standards. These regulations are shaping the future of real estate development and driving the industry towards greater sustainability.

Conclusion

The real estate market in 2024 is characterized by a complex interplay of factors including demographic shifts, economic conditions, technological advancements, and sustainability trends. Understanding these dynamics is crucial for buyers, sellers, investors, and policymakers to navigate the evolving landscape. As the market continues to adapt to new realities, staying informed and agile will be key to leveraging opportunities and mitigating risks in the ever-changing real estate sector.

4o the evolving landscape. As the market continues to adapt to new realities, staying informed and agile will be key to leveraging opportunities and mitigating risks in the ever-changing real estate sector.